So, what is digital decisioning?

It’s a way for businesses to manage their important, day-to-day business decisions, so that they can be better understood, verified, improved and automated. This increases the business value of decision-making and reduces the risk.

It’s a way for businesses to manage their important, day-to-day business decisions, so that they can be better understood, verified, improved and automated. This increases the business value of decision-making and reduces the risk.

Business decisions? You mean decisions like mergers and acquisitions, product development, hiring, initial public offerings?

No, we mean operational decisions. These are decisions larger companies are making 1000s of times a day as they conduct their business, for example: whether or not to approve a client loan request; whether to investigate an insurance claim or pay it; determine which products to offer a new or existing customer to promote a better relationship with them; calculate a client’s lifetime value as part of working out what price to offer them; decide if a given transaction is compliant with the regulations or not. In other words, decisions that impact their day-to-day relationship with their customers and their profitability. The way these decisions are made effectively define the company’s policy. When these are automated, they are called digital decisions.

No, we mean operational decisions. These are decisions larger companies are making 1000s of times a day as they conduct their business, for example: whether or not to approve a client loan request; whether to investigate an insurance claim or pay it; determine which products to offer a new or existing customer to promote a better relationship with them; calculate a client’s lifetime value as part of working out what price to offer them; decide if a given transaction is compliant with the regulations or not. In other words, decisions that impact their day-to-day relationship with their customers and their profitability. The way these decisions are made effectively define the company’s policy. When these are automated, they are called digital decisions.

Surely larger companies already have systems to automate these decisions?

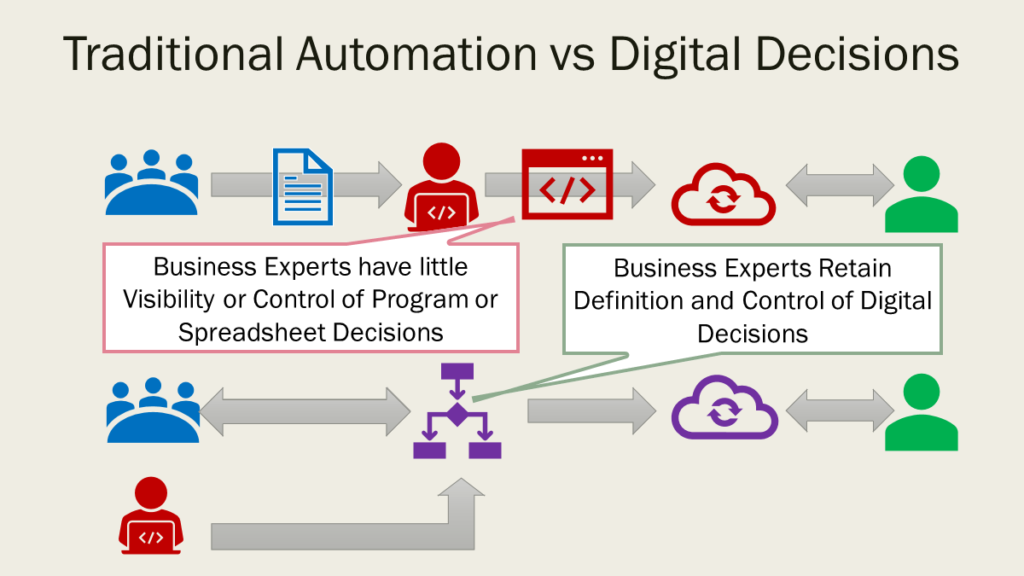

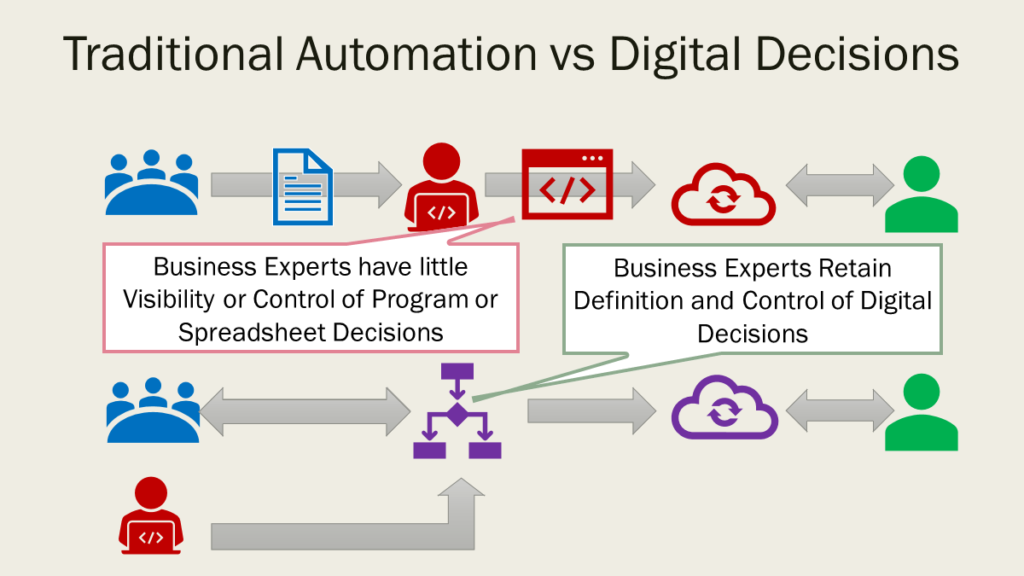

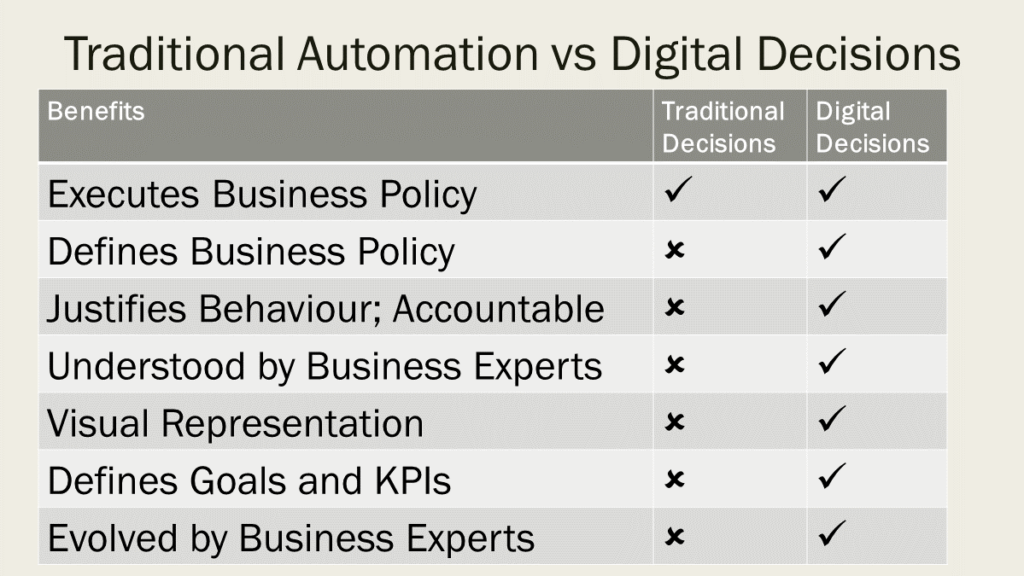

True, but most companies automate decisions by converting them into a technical format, for example a programming language or a complex spreadsheet. This means business subject matter experts and stakeholders who don’t understand this format become distanced from these systems. They lose their understanding how the decisions are really made – important business knowledge becomes ‘lost in the code’ and only the coders or Excel experts maintain a detailed grasp of it. When these key people leave the company, their knowledge goes with them – so the company’s understanding of the true behaviour of their automated systems can be compromised over time.

True, but most companies automate decisions by converting them into a technical format, for example a programming language or a complex spreadsheet. This means business subject matter experts and stakeholders who don’t understand this format become distanced from these systems. They lose their understanding how the decisions are really made – important business knowledge becomes ‘lost in the code’ and only the coders or Excel experts maintain a detailed grasp of it. When these key people leave the company, their knowledge goes with them – so the company’s understanding of the true behaviour of their automated systems can be compromised over time.

When policy know-how is buried like this it creates a barrier between a company’s subject matter experts and the way their automated decision-making really works. So, they can’t be sure decisions are made correctly or that they are consistent with the company’s written policies. This barrier also makes it harder (and slower) for experts to improve and innovate policies or adapt them to changes in the market.

In addition, the translation from experts’ requirements to a technical representation is slow and can introduce errors. It can also be hard for these businesses to understand the true business value delivered by decisions: how does each one contribute to the bottom line?

To resolve these issues we need a separate representation of business decisions, outside the code, that all business stakeholders can fully understand. These are called decision models.

Remind me, what are Subject Matter Experts?

Subject matter experts are people, already within your company, who really know the business very well. They have deep expertise in the business operations, processes, decisions and strategy. Some may be familiar with spreadsheets or even programming, but many are not. Often they are frustrated at the lack of transparency of their companies operational systems and how long it takes to implement new or improved policies.

How does having yet another, paper-based model of the decision logic help – surely it adds to the paperwork and contrary to agile processes?

Decision models are not paper-based documentation of business decisions, they are visual representations of decision-making that are also executable. They both define and implement business policy: you can build automated systems around them. But most importantly, decision models can be understood and maintained by subject matter experts. They are expressed in clear terms (e.g., decision tables) that more stakeholders can understand and use visual depictions of how decision-making works. This means your experts improve to digital decisions directly.

Furthermore, subject matter experts can experiment with a decision model: they can present hypothetical business scenarios and it will tell them the outcome of the decisions in these circumstances and why this is so. Because decision models are the basis of decision automation, they are never out of date or inconsistent with stated business policy: in effect the defined business policy and the automated implementation are the same. This is the essence of digital decisions and what makes it more agile.

Decision models include a definition of how to measure their business value, their key performance indicators (KPIs) – for example improved profitability, better client retention. You can use this to monitor the performance of decisions, set targets and to identify those decisions that are under performing.

Decision models are more transparent. With code or spreadsheets the explanation of a decision is very often lost in the technicalities of implementation. With a decision model, accurate execution is an outcome of an explicit explanation of business logic and its value. Decision models are visual representations of how your business logic works and how each decision depends on sub-decisions and input data. For these reason decision models are very transparent and accountable.

OK, but do we really need yet another representation of business logic? Most business subject matter experts just get familiar with the code. Some of the analysts at the companies I’ve worked with are real masters of Excel, SQL and Java.

Some may be, but many are not. Computer code isn’t an effective way of representing how a company makes important decisions – often the important business meaning is lost in the technical details. Insisting that all subject matter experts learn to code just isn’t practical and the skill set required to be a good coder is inconsistent with being an effective expert. Digital decisions can be understood by a much broader range of stakeholders, coding skills are not required.

Furthermore, code can’t be directly understood, verified or improved by many important policy stakeholders. Separating the business policies from your technical infrastructure and representing it visually, as a decision model, makes it clearer to more employees, including business stakeholders, how decision-making really works, whether it is correct and how well it contributes to the bottom line. Furthermore, it allows them to take control of its evolution.

‘Take control of its evolution’, what do you mean?

When you capture the logic of a business decision in a decision model, it’s now not only easier to understand but it’s executable. You can change it (in a test area) and see what impact that change would have on your company’s economic performance (both past and future). You can even compare the performance of established decision-making with new proposals to see which are better and by how much. This transparency also means you are in a better position to understand and justify your decision outcomes after the fact.

Pardon me, ‘justify your decisions’? What’s that all about?

By justify your decision, I mean explain, in a specific case, why a particular outcome was reached: why did you refuse that client a loan, why did you recommend a specific product, how did you calculate that insurance premium offer?

Why would you need to do that?

Well let’s say your automated systems have made a decision that is unexpected (e.g., refused a client a loan or decided to investigate their insurance claim). Let’s suppose it appears to be the wrong outcome. Firstly, a decision model will help you to understand if you made a mistake in a given case and, if so, why and how to fix it and make your decision-making even better in future. It could also help you explain why the decision you made is correct according to the business policy you’ve currently agreed, despite the fact that the outcome was unexpected. Decision models are connected to your business policy documents (internal policy mandates, regulations and even laws), so they can explain outcomes in terms of agreed policy documentation. Lastly, decision models can be used to justify your company’s behaviour to a third party.

Justify decisions to a third party? Why is that important?

Compliance regulations are increasingly demanding that companies are able to explain to regulatory bodies, and their clients, why certain decisions had the outcome that they did. For example, some regulations like (section 22 of) the GDPR insist that you can explain to clients in simple terms why you made the decisions you did.

Such scrutiny can also make it easier to prove your decisions are ethically sound, another focus of new compliance regulations.

Surely, you’re not going to explain your business decisions to an outsider? Isn’t that giving away your intellectual capital?

No. Decision models are very good at representing complex business logic in a format that’s both easy to understand by a business subject matter expert and that is executable in a business system. But they are also good at representing simplified views of decision logic, aimed at specific stakeholders – including the customer. You can choose exactly how much detail to share.

So, digital decisions are about making business decisions more visible to everyone (according to their needs) whilst being detailed enough to be executed as part of an automated system?

That’s right. The rigour of digital decisions has other benefits too. It can give you a better understanding of the true data needs when analysing new areas of decision-making. It can help you to embed artificial intelligence (AI), or more specifically, machine learning, into your business decisions. Also, it allows newcomers to the company to understand how the company works much more quickly and accurately than if they were being trained from out-of-date policy manuals or code reviews.

How do digital decisions help you to deploy AI?

Any business decision can be broken down into sub-decisions. Some of these are based on static rules, they can be represented as decision tables defined by business experts based on their experience and judgement. Other sub-decisions may ‘learn’ the best policy from historic company data using machine learning. These machine learning based sub-decisions can use the success of decisions made in the past to forecast the best action to take in the present. Furthermore, AI enabled decisions can continue to learn from past experience as they work, getting better at decision-making by continually adapting and learning.

Can you provide an example of that?

Sure. Consider an insurance policy pricing decision. This decision might use a combination of actuarial decision tables (the experience of experts), a machine learning model to predict the future value of a customer (based on existing records of similar cases) and decision tables to determine special offers (based on marketing expertise).

Decision making based on Artificial Intelligence sounds risky, don’t many AI projects fail?

In fact, digital decisions provide a business context for the use of AI techniques that reduces the risk of AI projects by ensuring that its goals are clearly defined and anchored in true business benefit. Many AI projects fail because they lack this context. Many companies, anxious to be seen to be using AI, embark on expensive and counter-productive fishing expeditions. The practice of decision modelling helps to improve the chances of successfully deploying AI.

I’m not sure my company would approve of AI based decision-making, what if the AI makes a mistake?

That’s an entirely understandable concern. However, digital decisions can mix machine learning with human oversight: the combination of machine learning, static decision tables and human stewardship that digital decisions facilitate is a very powerful one. Digital decisions can even test the ethical safety of your policy, for example by detecting bias with respect to a protected group (e.g., gender, race).

How have companies managed well enough up till now without digital decisions?

Well many of them have already adopted digital decisions and others are investigating the benefits. For those that have not, business policies are more complex, are applied more frequently and are changing faster today than at any other time in business history. The need for explicit and agile management of business decision-making that supports the explanation of decision-making behaviour has never been higher. Existing techniques just can’t provide this and companies that rely on them will adapt more slowly with more risk.

What’s the bottom-line here? What compelling reasons are there to adopt digital decisions?

Transparency. By opening up your automated decision-making to subject matter experts you reduce the chances of costly errors and improve the quality and consistency of your decision making.

Agility. The fact that digital decisions both define and implement business logic make them quicker to change (less time is lost translating them to code). Transparency makes these changes safer because you are better informed of all the consequences. This allows your business policy to adapt more quickly and safely in response to market changes.

Accountability. Digital decisions offer explanations for their behaviour, support compliance procedures and can be more easily tested for bias. Furthermore, the business performance of digital decisions can be monitored in real-time and any degradation can be quickly reported. The strong definition of the business value of decisions make them a low risk framework for introducing AI into operational decision making.

Digital decisions are powerful means of supporting rapid and continuous improvement in profitable business decision making.

About the Author

Jan Purchase has been working in investment banking for 20 years during which he has worked with nine of the world’s top 40 banks by market capitalization. In the last 13 years he has focused exclusively on helping clients with automated Business Decisions, Decision Modelling (in DMN) and Machine Learning. Dr Purchase specializes in delivering, training and mentoring all of these concepts to financial organizations and improving the integration of predictive analytics and machine learning within compliance-based operational decisions.

Dr Purchase has published a book Real World Decision Modelling with DMN, with James Taylor, which covers their experiences of using decision management and analytics in finance. He also runs a Decision Management Blog www.luxmagi.com/blog, contributes regularly to industry conferences and is currently working on ways to improve the explainability of predictive analytics, machine learning and artificial intelligence using decision modelling.

purchase@luxmagi.com | @JanPurchase | https://www.luxmagi.com