High Performance Automated Support for the IFRS-17 Compliance Standard

Introduction

Decision Management, is rightly perceived as a powerful enabler for automated regulatory compliance. Its decision models:

- Maximize the transparency of complex procedures and operational decisions, using a zero-code approach, so that all corporate stakeholders can understand and contribute to them – IT, subject matter experts and management.

- Provide a governance framework to support rapid implementation and changes to compliance solutions.

- Power the informed reuse of key compliance metrics to increase profitability and reduce risk outside of compliance.

- Increase the integrity of decision making, so that flaws in regulation specifications can be identified and addressed early.

- Provide a plain English explanation for every regulatory outcome – increasingly a requirement of financial compliance standards.

As a showcase of the power of this technique, we have created a zero-code, decision model of IFRS-17 (International Financial Reporting Standard 17, an accounting standard for insurance). This model both out performs traditional implementations and offers unprecedented transparency to non-technical domain experts. This article discusses our IFRS-17 model, our experiences in producing it and the implications for automated solutions to compliance.

IFRS-17

IFRS-17 is, a financial accounting standard for insurance firms.

“IFRS-17 generates metrics that are useful outside compliance. … compliance solutions might, in and of themselves, contribute to revenue maximisation, rather than being obligatory loss making projects”

IFRS-17 (International Financial Reporting Standard 17) is an insurance accounting standard issued in May 2017 (by the International Accounting Standards Board – IASB). It comes into force in May 2021 and mandates how insurance companies conduct financial reporting on the insurance (and re-insurance) contracts they issue.

Primarily it dictates how they recognise profit, loss, risks and performance and how they make their reports traceably dependent on prevailing market data.

It defines metrics, such as the contractual service margin (CSM), which provide real-time indications of the ongoing profitability of individual insurance contracts and contract groups.

Like many other modern regulatory standards, IFRS-17 generates metrics that are useful outside compliance. CSM for example can be used, with other factors, to predict the lifetime value of customers.

This presents the opportunity that compliance solutions might directly contribute to revenue maximisation. Rather than just being obligatory projects driven by fine avoidance and risk management.

Unlike older regulatory standards, IFRS-17 will demand processing transactions at a finer grain.

In some cases it mandates processing small groups of, or even individual, insurance contracts. Typically unnder IFRS-4, only large aggregates were processed. This trend will grow with the increased compiance focus on individual customers.

IFRS-17 solutions are typically implemented as:

- Add-in modules to behemoth products like SAS.

- Bespoke software in a 3GL.

- Or, worse, with vast spreadsheets.

The benefits these approaches provide in terms of familiarity and convenience are quickly lost because they don’t provide sufficient transparency, explanation or governance.

Additionally, many spreadsheets do not perform at high volumes and cannot scale and 3GL solutions take a great deal of time to develop and change—they lack agility.

Transparency, performance and agility are increasingly important in compliance applications because of the need:

- To explain the minutiae of corporate actions.

- To process contracts at a finer grain.

- For rapid change which often occurs soon after compliance regulation is first introduced.

Decision Management and Financial Compliance

Decision Management is the process of defining (and potentially automating) operational decisions. These are decisions larger companies are making thousands of times a day as they conduct their business:

- Whether to approve a loan.

- Should an insurance claim be investigated or paid.

- What products to offer a new or existing customer.

Our IFRS-17 Decision Model

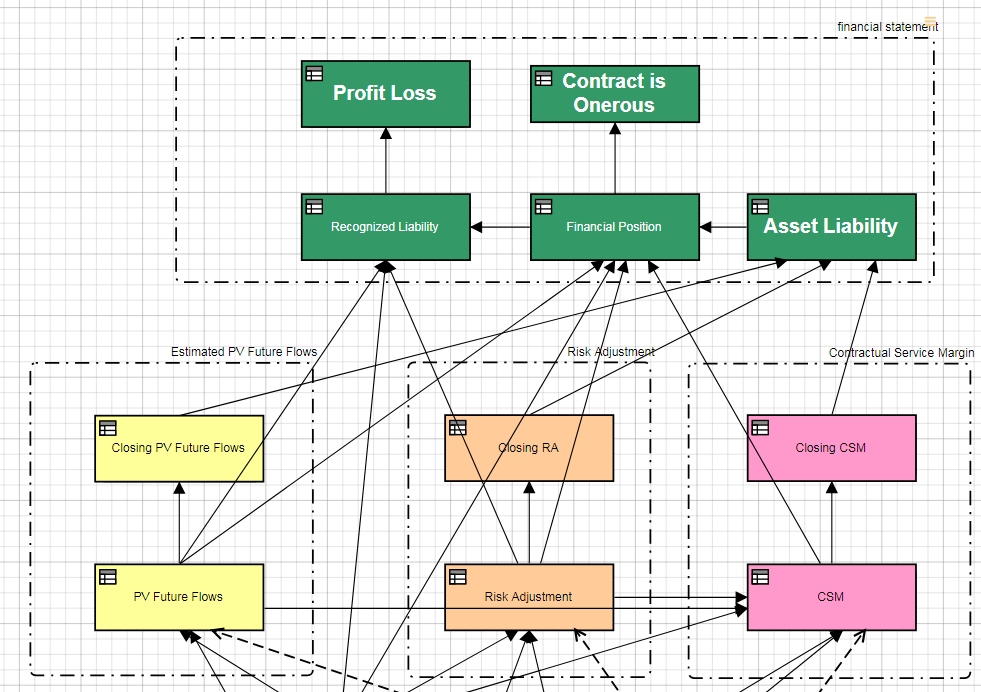

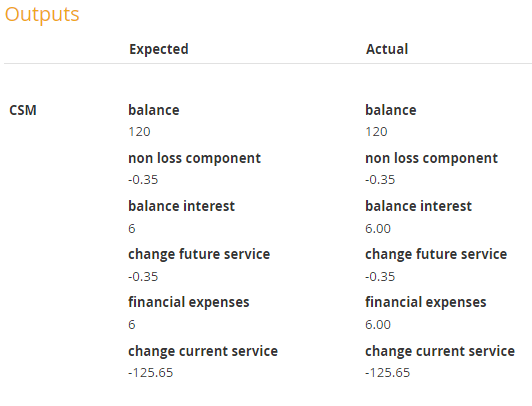

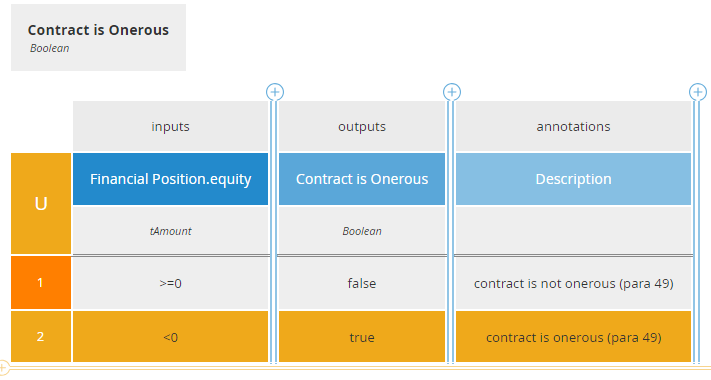

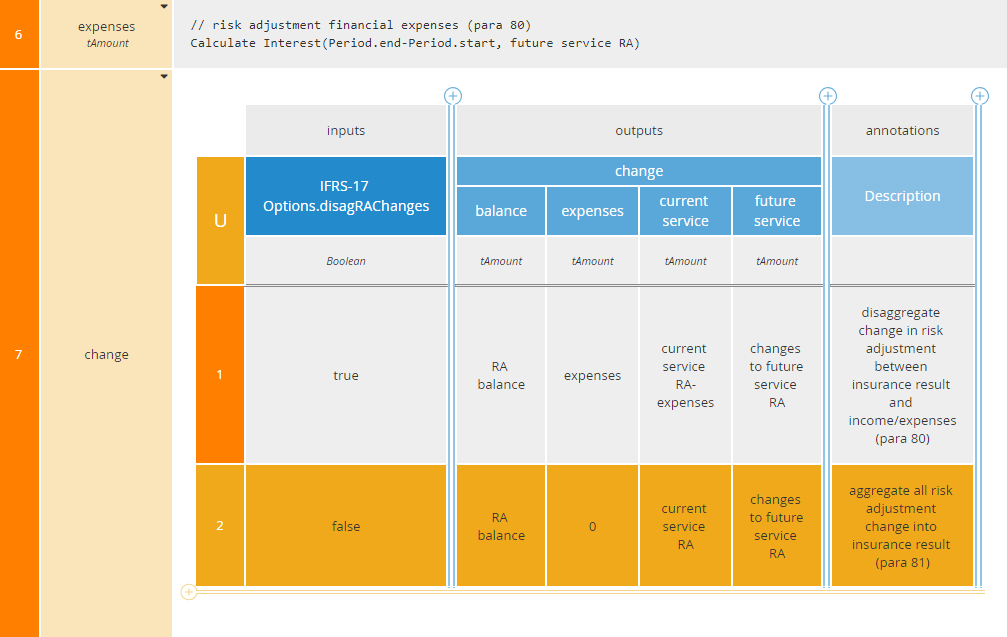

As a means of illustrating how decision management can facilitate these trends, we developed a decision model that implements the core of IFRS-17 and is capable of executing the first 57 sections of the IASB’s Illustrative Examples of IFRS-17 Contracts.

This decision model is a stand-alone model of business logic, represented using DMN, which:

- Serves as an unambiguous, compact representation of IFRS-17 business logic that a subject matter expert can understand and review.

- Is executable — that is to say insurance contracts can be provided to the model and it will provide financial statements.

Developing the Model

“The model took 9 man-days to develop, comprises 40 decision nodes and, when deployed to the RapidGen Genius Decision Execution Engine can outperform many commercial solutions by at least ten fold.”

Our evaluation confirmed:

Despite our previous experience of IFRS-17, the very act of developing a decision model gave us a deeper understanding of the standard and revealed opportunities for simplification. We also discovered some mistakes in early versions of the IFRS-17 standard.

Developing decision models fosters a deeper understanding of business logic and any flaws therein.

Despite the complexity of the IFRS-17 standard, the model only took 9 man-days to develop.

This is primarily due to:

- The flexibility and power of DMN — the notation of decision models.

- The fact that it is directly executable.

At all times, it was possible to execute the model against a benchmark set of insurance contracts and test that the output is correct.

Layer after layer of extra functionality could be added to our model in the certain knowledge that the foundations underpinning it were correct.

The IFRS-17 model occupies just two pages of Decision Requirement Diagrams (DRD) and 34 pages of description — this is about half the size of the original specification.

Because each stage of logic defines its dependencies on subordinate stages clearly, it is easy to understand and navigate. In fact the model could be used as the basis of IFRS-17 training—both theoretical and practical.

Model shown in Trisotech:

The objection that many have to modelling is that results are often just paper. DMN has a serious advantage in that it is both informative and executable.

However, IFRS-17 is a complex standard with a full definition running to many hundreds of pages. It requires extensive details on the insurance contracts it processes, including:

- Cashflow ladders

- Policy options (e.g., risk adjustment aggregation options)

- Coverage periods

- Burden

It has many options all of which have serious consequences for the reports it generates. It necessitates the calculation of several risk metrics and apportionments for each and every contract for each period. Despite this, using modest hardware we were able to obtain performance better than many bespoke 3GL systems.

Running it locally on a non-networked laptop, we were processing over 38,000 DMN decision nodes per second which translates to 50+ insurance contracts per second.

This allowed our model to process typical contract loads (200-500k contracts) in minutes rather than hours. This represents processing throughput at least ten times better than competitors, and performance improvements are ongoing.

In a future posting we will show how this is achieved.

Conclusion

This work establishes the direct relevance of the decision modelling technique and the high-performance RapidGen Genius component to the solution of demanding, automated compliance systems.

IFRS-17 is a complex standard that requires a contract-by-contract analysis of insurance portfolios. This is a much lower level of aggregation than traditionally used by insurance companies to generate their financial statements.

Despite the additional complexity and much higher processing volumes:

- DMN was able to yield a compact representation.

- This could be compiled by RapidGen to provide a highly performant solution capable of explaining its outcomes.

- The resulting decision model can be understood, reviewed and maintained by domain experts without the need to manipulate code.

“Such transparent, agile and high-performance solutions are the future for compliance automation in finance.”

About the Author

Jan Purchase has been working in investment banking for 20 years during which he has worked with nine of the world’s top 40 banks by market capitalization. In the last 13 years he has focused exclusively on helping clients with automated Business Decisions, Decision Modelling (in DMN) and Machine Learning. Dr Purchase specializes in delivering, training and mentoring all of these concepts to financial organizations and improving the integration of predictive analytics and machine learning within compliance-based operational decisions.

Dr Purchase has published a book Real World Decision Modelling with DMN, with James Taylor, which covers their experiences of using decision management and analytics in finance. He also runs a Decision Management Blog www.luxmagi.com/blog, contributes regularly to industry conferences and is currently working on ways to improve the explainability of predictive analytics, machine learning and artificial intelligence using decision modelling.

purchase@luxmagi.com | @JanPurchase | https://www.luxmagi.com